colorado tax refund reddit 2021

Filed 48 Accepted 411 971 and 570 showed up on my transcript on 429 971 first then 570 same date of 516 listed for both 571 and 846 on transcripts as of 56 DDD 511. Legislative analysts estimate almost 2 billion in refunds which would be largely spread over three checks to individual taxpayers around 50 apiece or more for most and into the low hundreds.

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

About 31 million Coloradans counting those who would have filed their 2021 tax returns by May 31 2022 are eligible for the rebate which amounts to 400 for individuals and 800 for joint filers.

. Ive received my state refund a few days back but not my federal. This change would increase the overall TABOR refund for people making 94000 or less. TAX TALK If youve received unemployment in 2021 you want to hear this Contact us today for a FREE ESTIMATE.

100s of Top Rated Local Professionals Waiting to Help You Today. Follow the Reissue Process below. At first glance this credit may sound like a simple flat rate but that is.

The official figure wont be out until the 2021-22 fiscal year concludes at the end of June but the Department of Revenue is almost certain the number will come in above the March projection. Continue browsing in rtaxrefundhelp. Individuals can track their tax refund using Revenue Online.

As part of a proposal that will be introduced the Colorado Dividend all Colorado taxpayers who file their 2021 tax returns by May 31 2022 will receive their rebate in. Under the plan individuals will receive 500 each and couples will get 1000. TaxColoradogov This book includes.

If you have not received yours give them a call and have them look at your record. The state is cutting the income tax rate next year and giving people a refund. The sales tax refunds for a given year typically are paid out after people file their taxes the following year but the plan announced Monday would send out 14 billion of the expected revenue surplus for fiscal year 2022 which ends June 30 a year early.

So my taxes were filed 319 and accepted same day. DR 0104X - Amended Individual Income Tax Return. The income tax rate will be cut from 455 to 450.

Depending on how Colorados economy does for the month of May the rebate could increase. DR 0204 - Tax Year Ending Computation of Penalty Due Based on Underpayment of Colorado Individual Estimated Tax. 211 Health Western Colorado.

DR 0158-I - Extension of Time for Filing Colorado Individual Income Tax. For example for single tax filers making between 47001-94000 the increase in refund is 42. And I only have one bar on the IRS WMR tool.

1 level 2 Ambition-Master Op 7 min. The Colorado Department of Revenue Division of Taxation will hold a public rulemaking hearing on the following sales tax rule at 1000 AM. Individual taxpayers may also receive a sales tax refund if they file a 2021 income tax return by October 18 2022.

Single filers would get 400 each while joint filers would get 800. 2021 Federal Refund Federal Tax Refund E-File Status Question Hey yall. If you received unemployment in 2021 this is for you taxreturn foryou tax2021 2022.

Joint filers will receive 166 on average. Anyone who filed taxes for 2021 will receive a rebate. A sales tax refund a temporary cut to the states flat income tax rate in this case from 455 to.

There is no such law for 2021. That was initially supposed to be 400 and 800 respectively. As in you may qualify for up to 7500 in federal tax credit for your electric vehicle.

To reach a live agent do this -. All taxpayers who file a 2021 income tax return will automatically receive the income tax rate reduction from 455 to 450. The Department of Revenue offers step-by-step instructions on how to do this as well as other resources regarding refunds.

Just keep calling for a few minutes straight and you will get through and be prompted through the menus. TODAY Colorado Governor Jared Polis signed Senate Bill 22-233 TABOR Refund Mechanism For FY 2021-22 Only into law getting a minimum of 500 tax refunds to Coloradans sooner to help ease the financial pain from the COVID economic crisis. Request the letter through 303-238-SERV 7378 Colorado Department of Revenue Income Tax Section PO Box 17087 Denver CO 80217-0087 Identity Verification Validation Key.

Simply choose the option Wheres My Refund for Individuals in the box labeled Refund Resources. The savings are split among three categories. The income tax rate will drop to 45 in 2021 down from 455 and individual taxpayers will get an additional sales tax refund payment on average of about 70.

For the six refund levels based on a taxpayers adjusted gross income see the 2021 form DR 0104. There is no need to login. Call 1-800-829-1040 - you may get a recording that they are too busy and to call later.

Ago Colorado You mean offsetting taxes wont occur definitely for 2021 1 More posts from the Unemployment. These tax cuts and refunds are a strong sign that Colorados economy is roaring back Gov. We are able to file anywhere in the USA.

Y DR 0104 2021 Colorado Individual Income Tax Form y DR 0104EE Colorado Easy Enrollment Information Form y DR 0104CH 2021 Voluntary Contributions Schedule y DR 0900 2021 Individual Income Tax Payment Form y DR 0104AD 2021 Subtractions from Income Schedule y DR 0158-I 2021 Extension Payment for Colorado. Tax return 2021 if you have received your refund either state or federal could please just simply state what bank you have Federal Tax Refund E-File Status Question If youd like to add other info like dates times and such feel free. TikTok video from htxtax htxtax.

You can check the status of your refund on Revenue Online. Jared Polis said in a written statement. Then enter your SSN or ITIN and the refund amount.

Im simply starting this thread to gather info on all the banks that have already filed refunds so far. Polis announces 400 rebate to Colorado taxpayers Watch on. Reissue Process for Missing Lost or Destroyed Refunds You can start the refund check reissue process by signing a refund reissue letter.

In calendar year 2021 the TABOR refund is estimated at 310 million to 412 million and in 2022 it is projected at 342 million to 623 million. My Tax Transcript still says NA when I go to look for the date scheduled DD for my federal refund.

How Taxes On Property Owned In Another State Work For 2022

My Tax Return Is So Low This Year When It S Been Generally Bigger Other Years And I Can T Figure Out Why I Worked Full Time All Year I Ve Looked Over My 1040

How To File Taxes For Free In 2022 Money

Where S My Child Tax Credit Payment A Guide For Frustrated Parents The Washington Post

Where S My Refund Colorado H R Block

Tax Refund Delay As Tax Season Heads Into The Home Stretch Some Taxpayers Are Still Waiting On The Irs To Finish 2019 Cbs News

Unemployment Benefits And Taxes Here S What To Do About Incorrect Tax Forms And Other Issues The Denver Post

Anonymous Answers Questions On Reddit Cbs News

Thank God I Finally Got My Date 2 24 22 R Irs

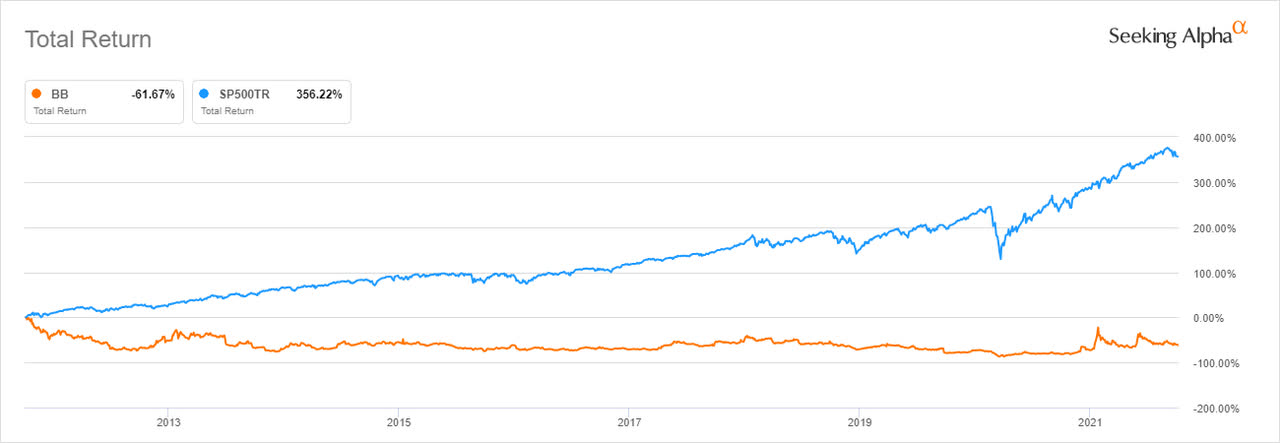

Blackberry Only Reddit Can Save This Stock Nyse Bb Seeking Alpha

Blackberry Only Reddit Can Save This Stock Nyse Bb Seeking Alpha

Reddit Raises 250 Million In Series E Funding Wilson S Media

Irs Notices Levy Came Fast R Taxpros

Tax Day Laggards Consider Filing For Extension If In A Rush The Denver Post

I Am Filling Out The Information For My 1099 G Form Is Payer Name My Name Is The Address My Current Address Or The Address When I Collected Unemployment